amazon flex quarterly taxes

How much will I owe at tax time. In case you are wondering why you have not heard of Amazon Flex before it is only because it is the least spoken about delivery programs.

How To File Amazon Flex 1099 Taxes The Easy Way

Most drivers earn 18-25 an hour.

. Amazon Flex - US. If you are using your own car for Amazon then you can choose to claim an amount for the number of miles you drive. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k.

Youll need to record the number of miles you do keeping a detailed log of where you have travelled and then claim the set amount by HMRC. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday. With only Flex amount stated youll be well below that number.

We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my cash flow. If you have a lot more 1099 side work you can add to your estimated quarterly due.

In your example you made 10000 on your 1099 and drove 10000 miles. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

How Much To Put Away For Quarterly Taxes. Driving for Amazon flex can be a good way to earn supplemental income. If you expect to owe taxes of 1000 or more youre usually required to make quarterly estimated tax payments.

You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. Knowing your tax write offs can be a good way to keep that income in your pocket. Those payments are generally due on April 15 June 15 September 15 and January 15 of the following tax year or the next business day due to a.

Claiming for a Car on Amazon Flex Taxes. Amazon Flex pays out twice weekly on Tuesdays and Fridays Quarterly Taxes After year 1 as an independent contractor you are expected to pay quarterly estimated taxes. You may also need to.

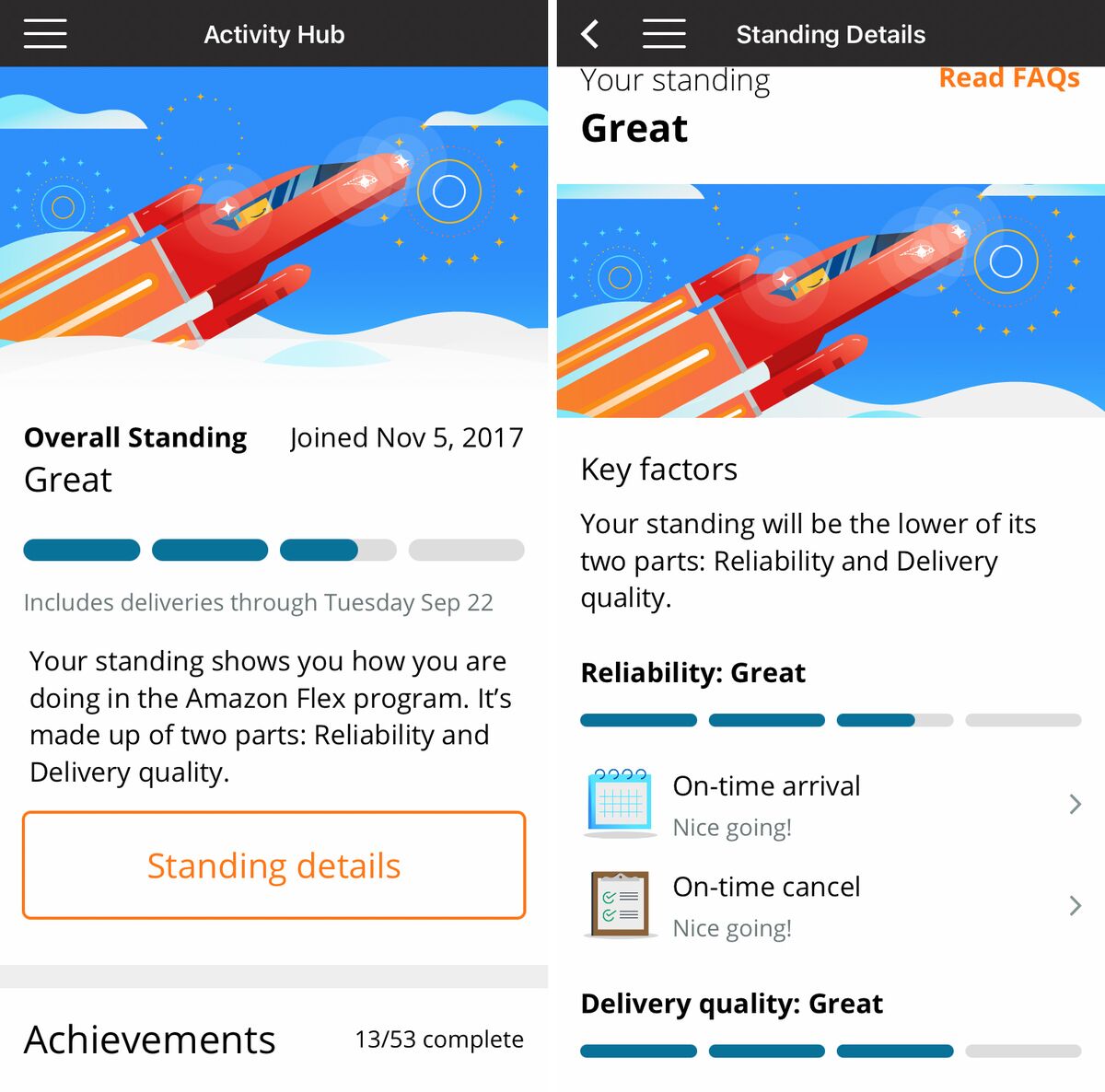

Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. Because working for Amazon Flex makes you an independent contractor youll be responsible for withholding money for your taxes.

How much should I set aside for taxes. Amazon annual income taxes for 2021 were 4791B a 6734 increase from 2020. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program.

However because Flex is an independent contractor job you have the opportunity to write off business expenses on your tax return. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. The rates are currently 45p for the first 10000 miles of driving.

Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments. Amazon income taxes for the quarter ending December 31 2021 were 0612B a 813 increase year-over-year. Amazon Flex is a service that offers rideshare drivers to make extra money on the side by handling grocery orders from PrimeNow Amazon Fresh and Whole Foods.

Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive. This is your business income on which you owe taxes. Amazon income taxes for the twelve months ending December 31 2021 were 4791B a 6734 increase year-over-year.

When do I need to pay quarterly taxes if I started driving for Amazon Flex this year. But you can write it off as a deduction on your taxes which means that you wont have to pay taxes on your gas money. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400.

Now doing this wont help you get the money back per se. The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022.

You expect your withholding and credits to be less than the smaller of. Once your direct deposit is on its way Amazon Flex will send you an email to let you know. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on.

As an independent contractor you will use the information on form 1099 from Amazon Flex to complete Schedule C and Schedule SE which in turn are needed to complete sections of Form 1040 that pertain to your Amazon Flex earnings and tax amounts. You are required to provide a bank account for direct deposit which can take up to 5 days to process. This form will have you adjust your 1099 income for the number of miles driven.

Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. Any info is appreciated everyone. Just claim the 1099 next year.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. Quarterly Tax Calculator Try it. Keep in mind that Amazon does not withhold or.

If youre looking for a place to discuss DSP topics head over to ramazondspdrivers. Amazon Flex quartly tax payments. I have to start doing my taxes every quarteris this true for you flex-veterans.

Understand that this has nothing to do with whether you take the standard deduction. Below is an example 1099 form with total earnings of 5500 noted in BOX 7. If so does amazon have a tax form for download every three months now.

Posted by 1 day ago.

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

Minka George Kovacs P4116 609 L 120v Flex Track Kit Track Kits Silver Lightingmarketplace In 2022 George Kovacs Light Silver

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Do Taxes For Amazon Flex Youtube

How To File Amazon Flex 1099 Taxes The Easy Way

What Is The Income Limit To Get Health Insurance Subsidy Tax Credit Health Insurance Health Insurance Coverage Tax Credits

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Arcade 1up Street Fighter Ii Big Blue Arcade Machine Rc Willey In 2022 Street Fighter Ii Arcade Arcade Machine

How To File Amazon Flex 1099 Taxes The Easy Way

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Fired By Bot Amazon Turns To Machine Managers And Workers Are Losing Out Bloomberg

How To Pay Taxes For Amazon Flex R Amazonflexdrivers

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To File Amazon Flex 1099 Taxes The Easy Way